Cornwall Insight has released its final forecast for the Q3 2023 Default Tariff Cap (price cap) set at £2,053.77.

Following the closure of the observation window on 18 May, the price cap prediction refers to the maximum price a typical household would pay per year for the period from July to September this year.

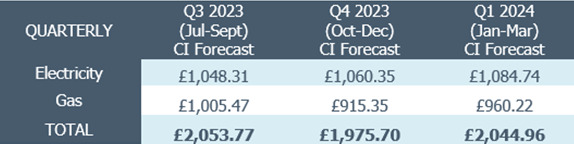

Figure 1: Cornwall Insight’s Default Tariff Cap forecasts (dual fuel, direct debit customer, national average figures)

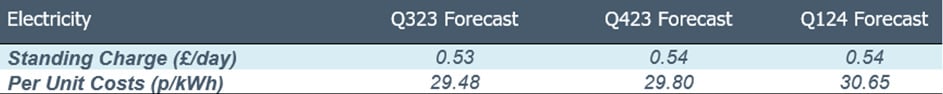

Figure 2: Default Tariff Cap forecasts, Per Unit Cost and Standing Charge including VAT (dual fuel, direct debit customer, national average figures)

Cornwall Insight’s final price cap prediction is less than £10 lower than its previous prediction of £2,053.77 and £1,227 lower than Ofgem’s April cap of £3,280.

Consumers were not directly affected by the April price cap due to the Energy Price Guarantee (EPG) capping a household’s energy bill at £2,500.

Alongside a predicted lower cap, July will see household bills revert to the price cap and Cornwall Insight expressed hope for a consequent “reappearance of more competitive fixed-rate energy tariffs.”

Despite the welcome reduction in energy prices, Cornwall Insight warned it does not expect energy prices to return to pre-2020 levels before the end of the decade at the earliest.

“Under these predictions, an average consumer would see bills drop by around £450 compared to the existing levels of the Energy Price Guarantee, with bills currently predicted to stay relatively stable over the next nine months. As many people continue to suffer from the cost-of-living crisis, this will hopefully bring some cautious optimism that the era of exceptionally high energy bills is behind us,” said Dr Craig Lowrey, principle consultant at Cornwall Insight.

“That is unfortunately where the good news ends. While bills are falling, the cap is still expected to remain comparatively high against historic norms, and those hoping to see a return to the kinds of bills seen at the start of the decade will be disappointed. Regrettably, it looks as if these prices may become the new normal.

“The forecasts call into question the cap’s purpose and its continued place in the energy market. While it has provided some level of protection for consumers against market volatility, it is clearly still not shielding the most vulnerable from enduring severe financial hardship. As our forecasts into 2024 indicate, energy bills will remain at levels that are still unaffordable for many.

“The cap was never intended as a permanent solution and we urge, as we have done previously, for a comprehensive review of the cap and the exploration of alternative mechanisms, such as social tariffs, that can effectively safeguard the most vulnerable. It is crucial to prioritise the development of sustainable solutions that address the affordability challenges faced by energy consumers.”