ENA reiterates support for a UK hydrogen network with five pledges

The Energy Networks Association (ENA) has released a new report outlining the need for governmental support to help deliver a UK hydrogen network and the need for a clear roadmap for a regulatory and market framework.

The report, named A Hydrogen Vision for the UK, showcases the need to integrate hydrogen technologies to support the decarbonisation of the UK. The report has been delivered alongside Cadent Gas, Mutual Energy, National Gas, SGN, Northern Gas Networks and Wales and West Utilities.

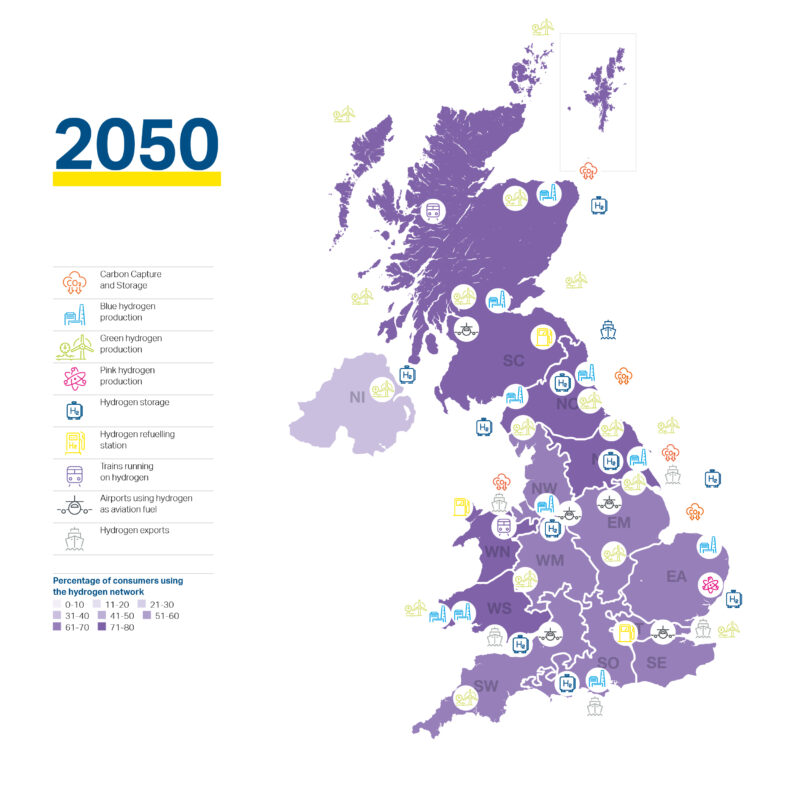

As the UK makes its net zero transition, hydrogen could provide between 20-35% of the UK’s energy demand by 2050, supporting the delivery of climate and security goals. However further support is required to ensure this can be delivered.

Outlined within the report, the companies agreed five pledges to support the growing hydrogen sector across the UK. These include:

- Playing a lead role in delivering against the UK’s hydrogen ambitions

- Conducting further research and testing, in an open and transparent manner

- Engaging with consumers across our networks on delivering net zero

- Working collaboratively with all stakeholders across the sector using a ‘whole system’ approach

- Investing in both developing a skilled workforce for the future and a UK supply chain

Hydrogen can provide a number of opportunities for the UK, as detailed within the ENA report. This can include a lower cost for net zero with low carbon heating solutions able to save consumers as much as £13 billion by 2050 in comparison to all-electrification.

In addition, increased energy security could be a side benefit should hydrogen be fully explored in the UK. The report reads: “Hydrogen can be produced, stored and used flexibly. Excess renewable energy can produce hydrogen, providing energy storage and back-up power generation, giving consumers confidence in the security of their energy supply.”

The government’s initial Hydrogen Strategy, released in 2021, set a goal of just 5GW of low-carbon hydrogen production by 2030 – significantly lower than countries such as the US, Germany and Australia.

A negative response from the industry prompted this figure to be increased to 10GW, with 5GW coming from green hydrogen. This was released as part of the Energy Security Strategy in 2022. Scotland also has outlined its intention to produce 5GW of hydrogen production.

Pivotal to this is the establishment of a hydrogen backbone to allow hydrogen to be transported easily up and down the nation, connecting offtakers wherever they are in the UK. Doing so could present fresh opportunities for decarbonisation and the adoption of hydrogen further cementing its role as a key enabling technology for net zero.

“If we are to hit the government’s decarbonisation targets, secure energy investment in an increasingly competitive global market and protect long-term energy security for customers then the government needs to make rapid progress across both renewables and hydrogen deployment,” said James Earl, director of Gas, Energy Networks Association.

“Gas network operators are ready to invest, innovate and deliver this vision for hydrogen’s role in the UK energy system, but we need certainty from government to let them plan with confidence. Our gas network members pledge to work collaboratively with government, the regulator, businesses and the communities they serve to explore and deliver the significant benefits that hydrogen can have to the energy system, industry, consumers and the UK economy.”

77% of UK businesses back hydrogen as part of energy improvement strategies, says Centrica

Three quarters (77%) of UK businesses back hydrogen as part of their energy improvement strategies, with a quarter (27%) set to implement a trial within the next two years, Centrica Business Solutions said.

Green hydrogen can provide several services in terms of decarbonisation. The clean energy carrier can be utilised across hard-to-abate sectors to complement electric technologies and also the transportation and aviation sectors.

According to Centrica’s research, three quarters (77%) of participants reported they had already or would implement hydrogen-ready technologies such as combined heat and power (CHP) units as a means to optimise energy consumption and reduce carbon emissions. More than a quarter (27%) are planning on doing so in the next two years.

Centrica’s research also outlined one of the biggest factors with this growing adoption: cost. “The biggest driver for investing in hydrogen is cost,” the report said. “A third (33%) of firms believe hydrogen will be a more predictable cost for them to factor into their plans than alternative fuels.”

“Organisations clearly see the potential of hydrogen in creating a net zero future, where energy costs are more predictable than those imported from overseas. A progressive approach to modern energy technologies that incorporates hydrogen will mean firms benefit from reduced carbon emissions and lower energy costs,” said Justin Jacober, director of Centrica Business Solutions UK and Ireland.

“What we need to see next is the UK invest in hydrogen and get ready to deploy technologies more quickly. By investing now, the UK can make sure it is a leading hydrogen economy. A fully realised hydrogen strategy has the potential to improve flexibility within the grid and enable us to better harness the power of renewables, which will be essential if we’re to reduce renewable curtailment and eliminate carbon emissions.”

UK ranked as one of the global leaders in low-carbon hydrogen, says Cornwall Insight

Cornwall Insight has ranked the UK third amongst countries that have the potential to be global leaders in the new hydrogen economy.

Detailed within Cornwall Insight’s Hydrogen Index, the data has seen the UK dramatically increase its global position in the hydrogen market and has now seen it overtake Spain and Japan in its efforts to establish a healthy low-carbon hydrogen economy.

The index ranks the UK only behind South Korea and Germany, both of which remain in the same position in the previous edition of the rankings. The UK instead rose two places.

According to Mollie McCorkingdale, market analyst at Solar Media, the UK’s hydrogen pipeline had grown to 1.8GW, with 1.2GW being added in 2022. This was stated at the Green Hydrogen Summit in Lisbon, Portugal, earlier this week.

McCorkingdale said: “Since the beginning of 2022, 32 projects have been announced, adding a total of 1.2GW capacity. Throughout the year, 42MW across six sites were submitted into planning, 218MW across eight sites had been approved in planning, 7.4MW across two sites started construction and 14MW were under construction currently.”

Germany’s position at the top of the ranking is primarily due to its bigger ambitions. The German government increased its ambitions by committing to an additional 5GW of low carbon hydrogen production by 2035 if possible and no later than 2040, bringing its total target capacity to 15GW.

“As the UK journeys towards achieving net zero emissions, the potential of low carbon hydrogen to facilitate decarbonisation has emerged as a key topic of discussion, both domestically and globally. While the debate around its relevance in a domestic context continues, we believe that hydrogen could play a critical role in moving the industrial economy towards a more sustainable future,” said Jamie Maule, research analyst at Cornwall Insight.

“The movement of the UK up the low carbon Hydrogen Index rankings demonstrates a determination from the government to deliver a greener and more efficient energy system, while also acknowledging the potential economic benefits and job opportunities that can arise from developing a low carbon hydrogen sector.

“The commitment to increase the capacity of hydrogen is furthermore a positive step towards the UK becoming more energy self-reliant, lowering our need for costly and volatile imports.”

Despite this positive progress in the UK, Maule also believes that the UK could well go further and cement itself as a leader within the low-carbon hydrogen economy.

“The UK’s low carbon hydrogen strategy can always go further, and it has some way to go to meet the target commitments of Germany. Hopefully more clarity will be provided to investors and developers around business models, as stable and long-term revenue streams will be essential to unlock the critical mass of private capital needed for the development of the hydrogen economy.

“Nevertheless, the UK has made significant strides in the past year, and we remain optimistic that this progress will continue in the low-carbon hydrogen sector.”