Ofgem has opened a consultation on its intended decision to reject six of seven interconnector projects from the third application window for the cap and floor regime.

The energy regulator’s cap and floor regime was implemented in August 2014, setting minimum and maximum levels for interconnector revenues. If revenues, or margins, were below the ‘floor’, customers would top-up the difference, whilst any earnings above the ‘cap’ would be returned to customers.

The regime has been successful in attracting investment and increasing Britain’s interconnector capacity, however, Ofgem has now expanded the assessment frameworks (Initial Project Assessment (IPA)) for projects applying to the upcoming Window 3 cap and floor round, going beyond socioeconomic welfare (SEW) to consider the broader benefits of interconnectors such as security of supply and decarbonisation.

Ofgem also revealed it had placed more stead in the “maturity and deliverability” of projects.

“Interconnectors are no longer expected to predominantly be a source of cheap electricity imports as they have been when the cap and floor regime was first established, but instead going forward will become a way of providing flexibility and enhancing security of supply in a renewables-dominated energy system,” wrote Ofgem in its consultation summary.

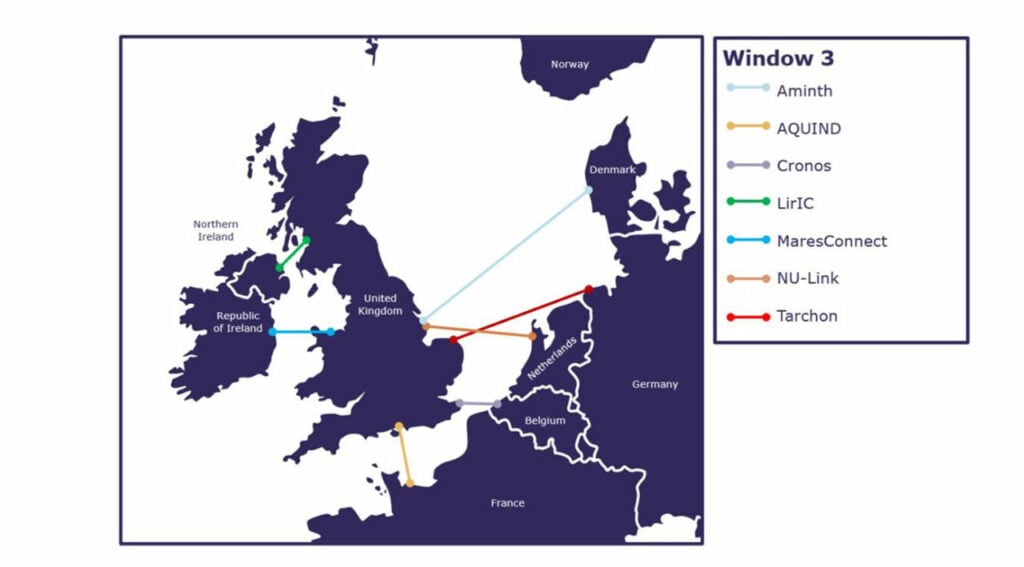

Using this broadened assessment within the third application window (which ran from September 2022 to January 2023) for projects set to start operating before 2032, Ofgem’s “minded-to” decision is to reject six of the seven applicant interconnector projects.

Ofgem’s minded-to positions for Window 3 IPA

| Project (Applicant) | Capacity | Location | Minded-to position | High-level reason |

| Aminth (Copenhagen Infrastructure Partners) | 1.4GW | Mablethorpe, Lincolnshire, GB, to Danish Energy Island | Reject | Deliverability, project currently appears unviable |

| AQUIND (AQUIND LIMITED) | 2GW | Lovedean, Hampshire, GB to Barnabos, Normandy, France | Reject | Reservations surrounding high constraint costs |

| Cronos (Copenhagen Infrastructure Partners) | 1.4GW | Kelmsley, Kent, GB, to Belgium | Reject | Reservations surrounding high constraint costs and deliverability |

| LirIC (Transmission Investment) | 0.7GW | Kilmarnock South, Scotland, GB to Kilroot, Northern Ireland | Reject | Reservations surrounding negative SEW |

| MaresConnect (MaresConnect Limited) | 0.75GW | Bodelwyddan, North Wales, GB, to Republic of Ireland | Reject | Reservations surrounding negative SEW |

| NU-Link (NU-Link Consortium) | 1.2GW | Mablethorpe, Lincolnshire, GB, to Vijfhuizen, Netherlands | Reject | Reservations surrounding deliverability |

| Tarchon (Copenhagen Infrastructure Partners) | 1.4GW | East Anglia (yet to be constructed), GB, to Niederlangen, Germany | Approve | No material concerns identified |

As shown above, the only project that Ofgem is inclined to approve is the 1.4GW Tarchon to Germany. Explaining it’s reasoning Ofgem noted: “Our modelling indicates the project would provide a total welfare benefit to GB, and the project has demonstrated that it is mature and likely to connect prior to the end of 2032. We note the moderate constraint cost impact of the project.”

Ofgem submitted its recommendation to approve the 1.4GW UK-Germany Tarchon Energy link last Friday (1 March).

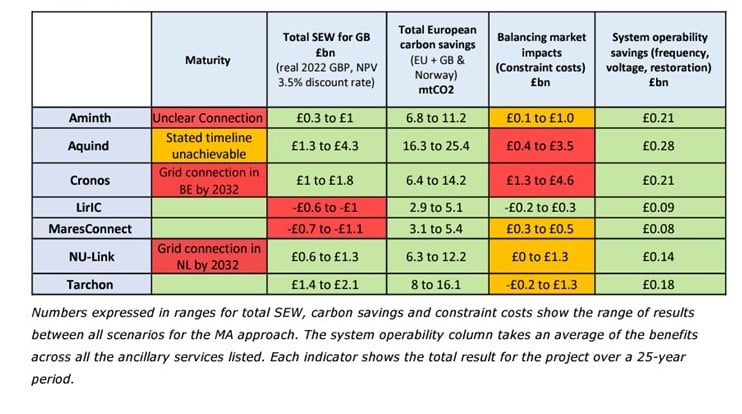

Of the projects considered for rejection, Ofgem reported uncertainty surrounding grid connection obtainability and operation timeline for four of the six projects. Balancing market (BM) impacts and total SEW costs were other concerns.

Summary of Window 3 project performance across the IPA

These proposals are now open for consultation as Ofgem seeks views from stakeholders. The consultation will run until 30 April 2024, with a decision hoped to be made this summer.

In a recent blog, Current± explored the role that interconnections will have in net zero, including a breakdown of the nation’s current and projected capacity.