Energy regulator Ofgem has revealed it is extending its consultation on implementing a cap and floor mechanism for interconnectors in the UK.

The consultation, which examines the financial parameters of the cap and floor regime for electricity interconnectors in Ofgem’s third application window, also known as Window 3, has been extended so that the energy regulator can seek “detailed parameters for the cap rate of the mechanism”. An initial consultation took place in September 2023.

Ofgem stated that in its paper supplementing the consultation, it proposes a methodology for estimating the equity beta parameter for Window 3 interconnectors and updates the methodology for Total Market Return and Risk-Free Rate.

The energy regulator’s cap and floor regime was implemented in August 2014, setting minimum and maximum levels for interconnector revenues. If revenues or margins were below the ‘floor’, customers would top up the difference, while any earnings above the ‘cap’ would be returned to customers.

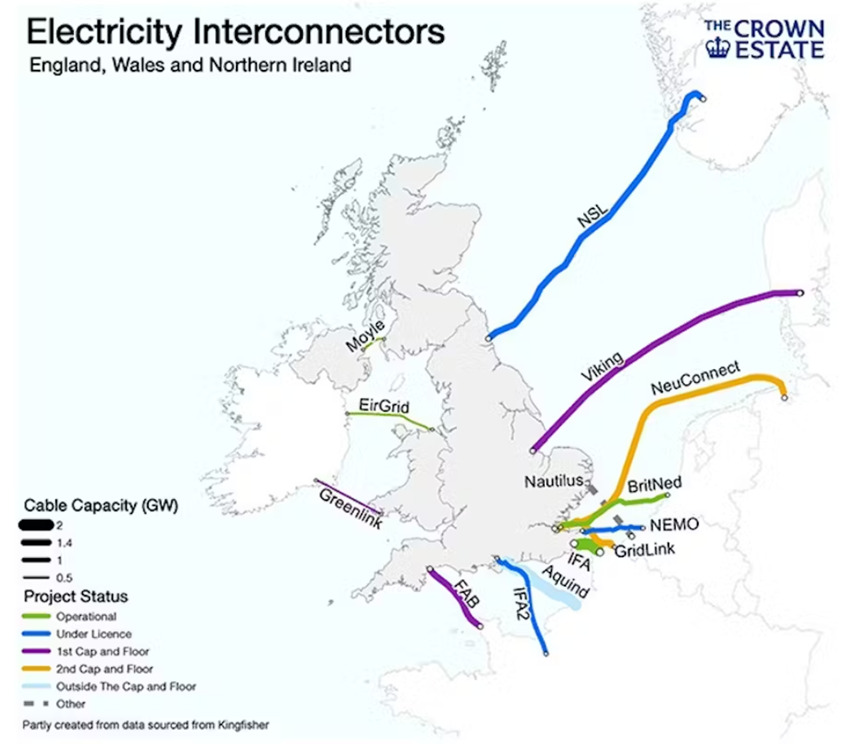

The regime has successfully attracted investment and increased Britain’s interconnector capacity. However, Ofgem has now expanded the assessment frameworks (Initial Project Assessment (IPA)) for projects applying to the upcoming Window 3 cap and floor round, going beyond socioeconomic welfare (SEW) to consider the broader benefits of interconnectors such as security of supply and decarbonisation.

Previous consultation coverage revealed that Ofgem plans to reject six of seven interconnector projects from the third application window for the cap and floor regime.

A final decision on the mechanism will take place once further considerations have been submitted. Current± explored the role that interconnections will have in net zero, including a breakdown of the nation’s current and projected capacity in a blog released earlier this year.