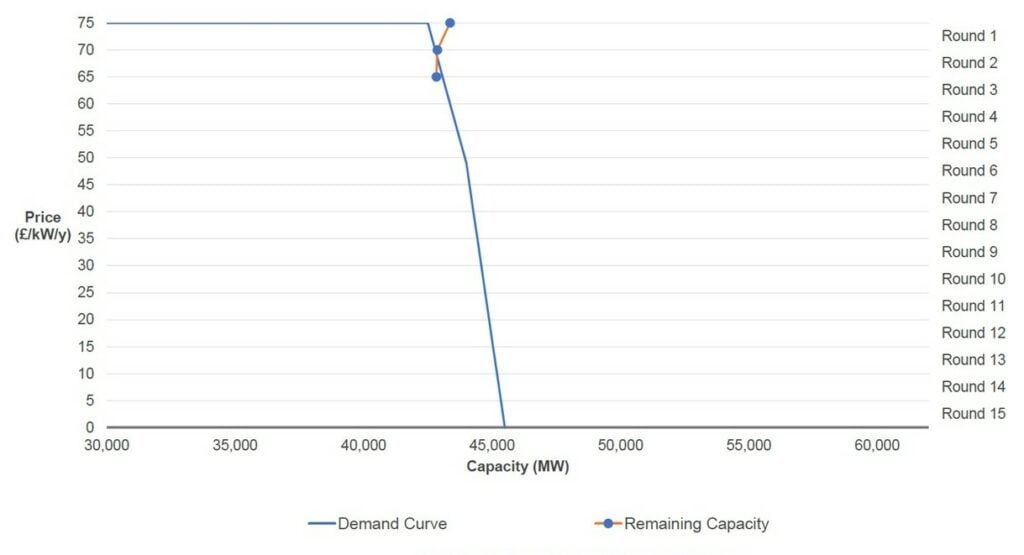

The T-4 Capacity Market Auction (CMA) for delivery year 2027/28 cleared yesterday (27 February) after two rounds at an “all-time high” clearing price of £65/kW/year.

Fintan Devenney, senior energy analyst at energy data analyst EnAppSys, noted that this “all-time high” is £2/kW/year higher than the 2023 auction clearing price “which was itself a record high at the time.”

According to the National Grid ESO’s preliminary results, the auction round secured 42,830MW – less than 2,000MW lower than the auction’s revised target of 44GW – with 98.76% of capacity entering the auction awarded an agreement.

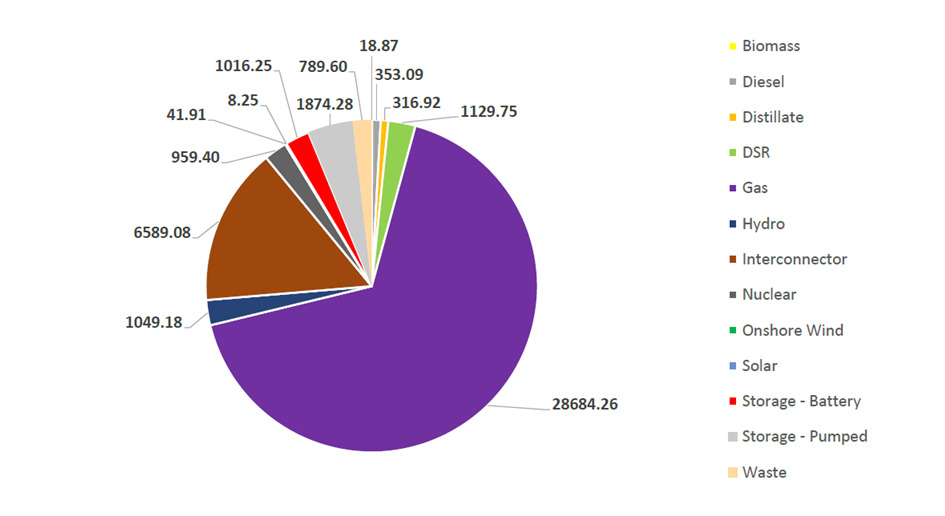

Capacity Awarded by Primary Fuel Type (MW)

As in the T-1 CMA for delivery year 2024/25, gas was awarded the majority of capacity, securing 28,684MW (66.97%), followed by interconnectors at 6,589MW (15.38%).

Pumped storage secured the most capacity of the low-carbon technologies entered into this year’s auction, securing 1,874MW (4.38%) battery storage received 1,016MW (2.375), nuclear 959MW (2.24%), onshore wind 41.91MW (0.10%), and solar 8.2MW (0.02%).

According to Devenney, despite having pre-qualified before the start of the auction, the newly built Killingholme combined cycle gas turbine (CCGT) unit did not enter this year’s auction.

Additionally, the Eggborough open-cycle gas turbine (OCGT) exited in the first round removing the combined 700MW of both assets from the auction.

“A further ~250MW of capacity from smaller assets also exited in the first two rounds and, combined with the exit of Eggborough OCGT, this was enough to cause the auction to clear at an all-time high price as total capacity supply dropped beneath the demand curve,” added Devenney.

Echoing sentiments expressed by Drax earlier this week, Deveney noted that the margin of capacity above the demand curve was “lowest ever seen in a T-4, with 43.3GW entering against a target of 44GW.”

A new report commissioned by Drax revealed that 2028 would see an energy ‘crunch point’ where demand will exceed secure dispatchable baseload capacity by 7.5GW at peak times. According o the report, this means that the results of the 2024 T-4 CMA, specifically how much capacity is awarded in relation to the target, will decide the “scale of the energy crunch.”

According to a LinkedIn post by Charlotte Johnson, global head of markets at Kraken, Drax itself won 230MW of refurb contacts for its pumped storage asset, alongside 20MW of biomass.

Johnson also noted that existing technology only made up roughly 39GW, meaning that new builds were needed.

Joining the conversation on LinkedIn, Cornwall Insight added that the clearing price for the T-4 CMA is “broadly in line with our expectations, with our latest forecast suggesting the auction would clear in the second Bidding Round. A deficit between prequalified existing generating capacity and the procurement led to expectations of a high clearing price.

“Government increased the procurement target of the auction, despite a number of existing generating sites, including nuclear and biomass, opting out but expecting to remain operational over the Delivery Year.”